Last part- Dominate the Markets with Smart Technical AnalysisTA 101 – Part 5

Chart Scaling Technical Analysis

There are two types of vertical pricing scales that can be used to produce charts. Price is equally spaced throughout the chart’s right side using an arithmetic scale. The distance between $10 and $20 on an arithmetic chart is half as tall as the distance between $20 and $40. Price is equally spaced in percentage terms using a log scale. Since they show the same % growth, the chart spacing between $10 and $20 is exactly the same as that between $20 and $40.

The distinctions between the two scaling techniques are seen in the SharpCharts above. To follow the price advance on the mathematical scale, three distinct trend lines were needed. The trend line on the log scale represents the price trend over the course of the rally. When employing trend lines, especially over extended periods of time, log scaling ought to be the initial scaling option.

Volume

StockCharts.com provides several ways to plot volume data on a chart. The following price and volume SharpChart of AAPL illustrates how volume is typically plotted.

Volume can be plotted in an ‘indicator panel’ above or below the ‘price plot area’ or in the price plot area as an ‘overlay.’

When the ‘Color Volume’ option is used, the volume bars are shown as black for up days and red for down days. Color volume bars allow the chartist to quickly see where heavy or weak buying and selling activity is happening.

CandleVolume Charts Technical Analysis

CandleVolume charts are similar to candlestick charts except that each candle’s width is proportional to its corresponding volume value. This charting style allows one to visualize the volume activity “in” rather than “below” price moves. Depending on the style of analysis, volume bars could be omitted to simplify the chart.

Because candlestick bar widths fluctuate with volume levels, the time axis of these charts is not evenly spaced. Therefore, a regular candlestick or OHLC chart should always be used to corroborate trend line analysis utilizing CandleVolume charts. The relationship between volume bars and candlestick widths is displayed in the AAPL SharpChart above.

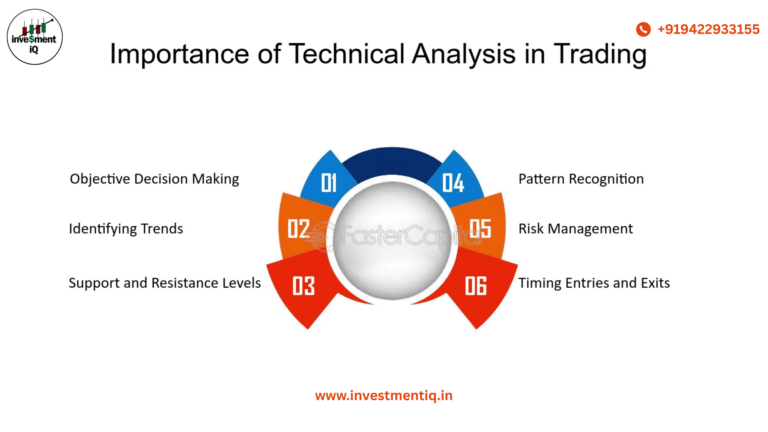

That wraps up our look at how charts are constructed. In part 7 we’re going to start to talk about how charts are analyzed – starting with Support and Resistance analysis.

you may be interested in this blog here: