Chart Analysis – Support and Resistance Technical Analysis

Fear and greed, two of humanity’s most powerful emotions, influence prices. A stock drops when more investors are afraid it will! Until the equilibrium between Fear and Greed is restored, it will keep declining. The same is true for price increases and greed. Market psychology is the term used to describe this phenomenon.

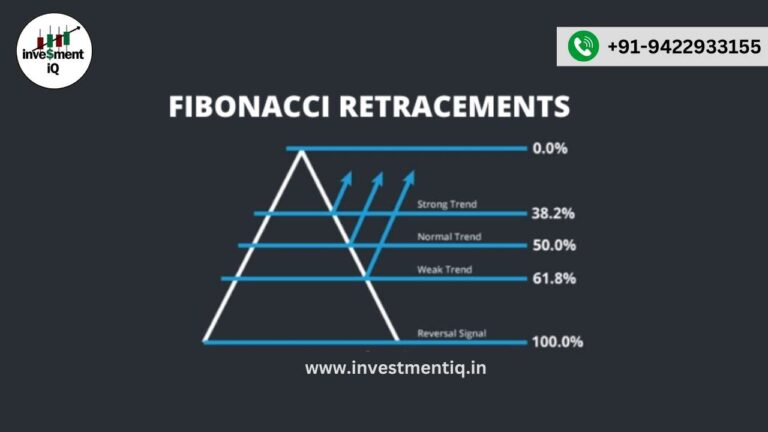

The accompanying diagram shows how the prior area of price support becomes resistance due to market psychology. Traders who bought in the support zone are currently holding losses after breaking support, and they want to sell as soon as prices get close to their initial buy levels in order to break even.

The Volume by Price overlay (volume traded in incremental price ranges) in the following SharpChart of Dover Corp. illustrates how strong support at 24 later became significant resistance as greed turned into fear.

As was previously mentioned, resistance is the antithesis of support. The price level at which “fearful” sellers abruptly enter the market and stop prices from rising further is known as resistance. Similar to support, resistance can form at a particular price or within a price range and persist for several months.

The prior location of price resistance becomes support if the resistance is broken due to market psychology. This market behavior is depicted in the above diagram. When prices get closer to the level they sold at earlier, stockholders who sold in the zone of resistance now regret their decision and wish to buy. Previously exorbitant prices now appear to be a good deal. Parker Hannifin Corp.’s SharpChart below shows how resistance eventually turns into support. Take note of how Volume by Price shows how many past sellers could be eager to repurchase if given the chance.

In part 8 we’ll discuss trend line analysis and trend channels.

you may be interested in this blog here: