IMPORTANCE OF TECHNICAL ANALYSIS

1. Integration with Other Analysis: We can use technical analysis in addition to fundamental analysis. To refine our entries in fundamentally strong stocks.

Example: An investor may use technical analysis to time an entry into a stock but base his/her assessment of the company’s health and its future growth potential on fundamental analysis.

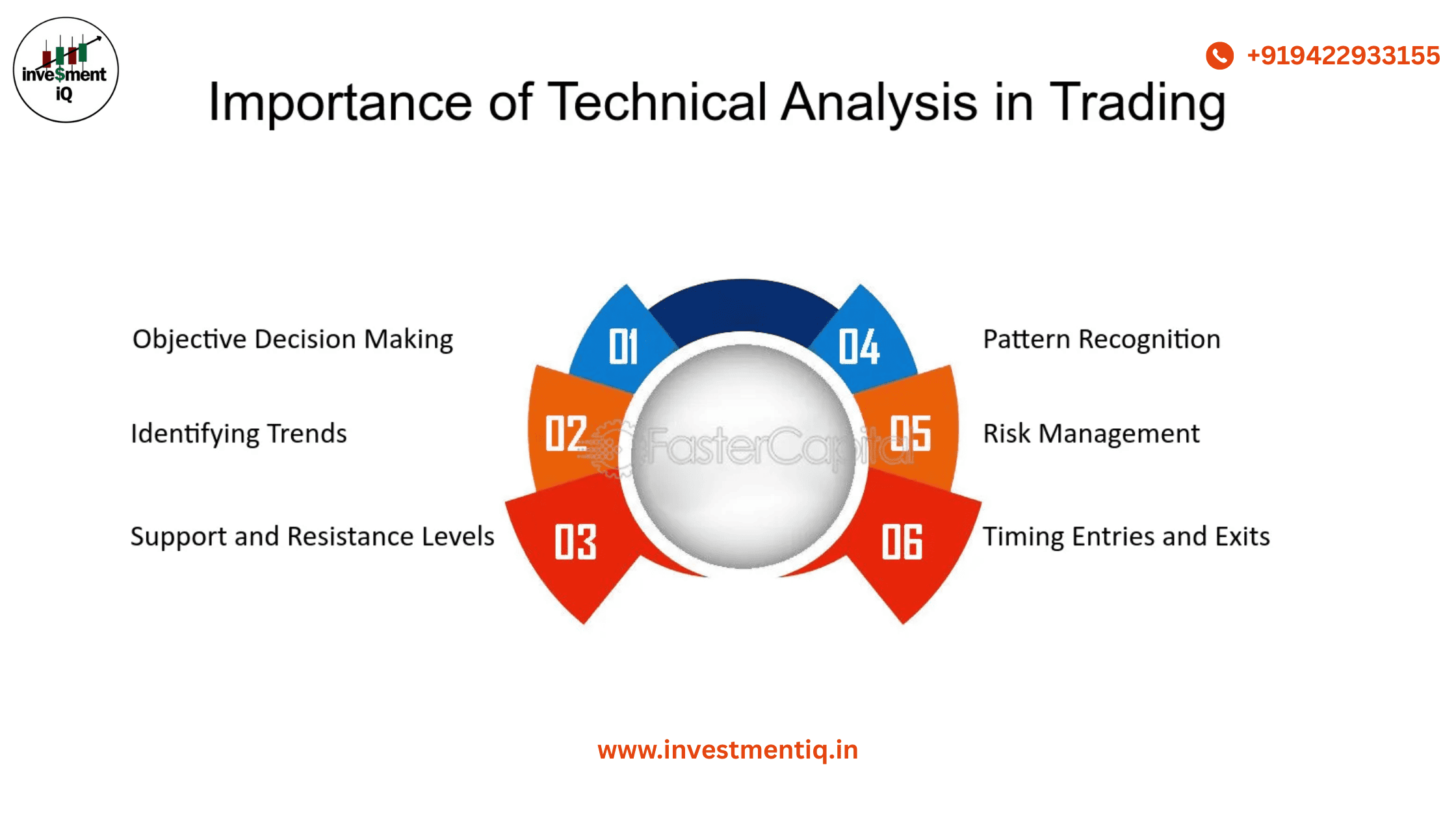

2. Understanding Market Trends: Conceptualizing market patterns is central to the technical analysis notion. Traders can spot trends that can indicate future moves by examining and analyzing past price data as well as chart patterns.

Example: Where the technical analysis indicates a protracted upward trend in the price of a particular stock, an investor could buy and hold in anticipation of a continuation of such a trend.

3. Risk Management:Risk management is crucial since trading and investing require taking measured risks. Traders can manage their risks by identifying stop-loss and take-profit levels using technical analysis. A trader, having analyzed the historical movements of price and volatility, can establish levels at which he will exit in a trade when the market moves against his expectations to cut his losses.

Example: A trader might set a stop-loss order just below a support level identified through technical analysis, protecting themselves from excessive losses if the price falls below that level.

4. Psychological insights: Markets are driven by human emotions and behaviors, which mostly follow a trend and repeat themselves from time to time. In technical analysis, the appearance of such patterns in the market depicts market psychology. Knowing these will enable traders to predict what may happen next and carry out a more effective strategy.

Example: Reversal models such as head-and-shoulders and double tops allow traders to anticipate changes in market sentiment and prepare for them by providing them with clues about potential reversals.

Technical analysis is not limited to stock markets; it may be used in a variety of markets. Technical analysis helps us make trading decisions by analyzing price action. Technical analysis can be used to study the price of any financial asset that is being traded. Technical analysis can be used to examine markets for commodities, currencies, stocks, cryptocurrencies, and more.

5. Development of Trading Strategies: It thus inherently creates a means for developing and testing a trading strategy. With backtesting against historical data, traders can refine their method and improve the chances of success regarding live trading.

Example: The trader can create a strategy based on the moving average cross and test it using past price movement to see how successful it will be in real-time trading.

One of the main advantages of technical analysis is that it provides the timing of entry and exit. Technical analysis indicates when to purchase or sell the stock, whereas fundamental analysis provides information on a company’s inherent value. By examining patterns and technical indicators, traders can identify the optimal times to enter and exit the market, maximizing profits and minimizing losses.

Technical indicators, like Moving Averages or RSI, could, for example, give overbought or oversold readings to yield better entry or exit timing for the trader.

Conclusion: Technical Analysis’s Power

For traders and investors who want to make wise choices in the financial markets, technical analysis is an essential tool. Traders can predict market behavior and improve their tactics by examining price movements, trends, and chart patterns. Gaining proficiency in technical analysis improves your capacity to recognize lucrative possibilities while skillfully managing risks, regardless of your level of expertise as an investor.