Decision Point Intermediate-Term Breadth Momentum Oscillator (ITBM)

Compared to the shorter-term McClellan Oscillator, the ITBM provides a distinct viewpoint on breadth.

Carl Swenl in created the Intermediate Term Breadth Momentum Oscillator (ITBM) to offer an alternative viewpoint for interpreting the McClellan Oscillator. This indicator is computed using the Ratio-Adjusted version of the McClellan Oscillator.

Calculating ITBM

To calculate the ITBM, add the daily McClellan Oscillator (Ratio-Adjusted) to the daily 10% exponential average (Ratio-Adjusted), then calculate a 20-day EMA of the result.

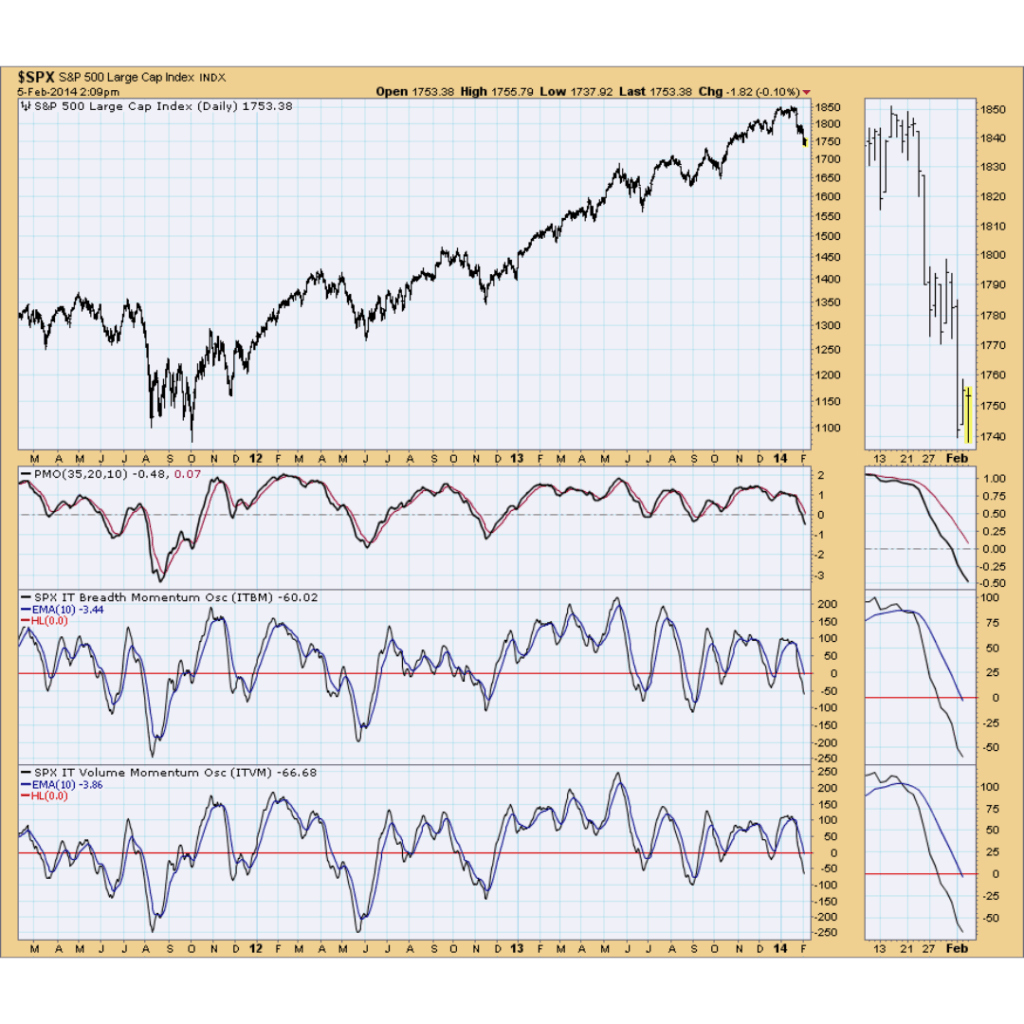

Interpreting ITBM

A measure of breadth is the ITBM. The market’s level of over boughtness or oversoldness is indicated by the absolute value.The most crucial factor is direction since it shows whether temarket is strengthening (rising) or contracting (falling).The ITBM is in the best position when it is rising above its 10 EMA, and it is in the worst position when it is falling below it. If the ITBM tops below both the zero line and its 10-EMA, it is very bearish.

DecisionPoint Intermediate-Term Breadth Momentum Oscillator (ITBM).

ITBM on StockCharts.com

StockCharts.com offers the ITBM as a collection of indexes, or ticker symbols that begin with the letter “!” since it is a market indicator. View those indexes by

The ITBM is also featured in the Decision Point Market Analysis Chart Gallery tool. Click here to see that tool.

The Bottom Line

In contrast to the shorter-term McClellan Oscillator, the ITBM is an intermediate-term indicator that provides a distinct viewpoint on breadth. Additionally, chartists can utilize it to inform them whether the McClellan oscillator is negative.