Methods to Establish Support and Resistance?

Highs and Lows Support can be established with the previous reaction lows, while resistance can be established by using the previous reaction highs. The below chart of Halliburton (HAL) shows…

Highs and Lows Support can be established with the previous reaction lows, while resistance can be established by using the previous reaction highs. The below chart of Halliburton (HAL) shows…

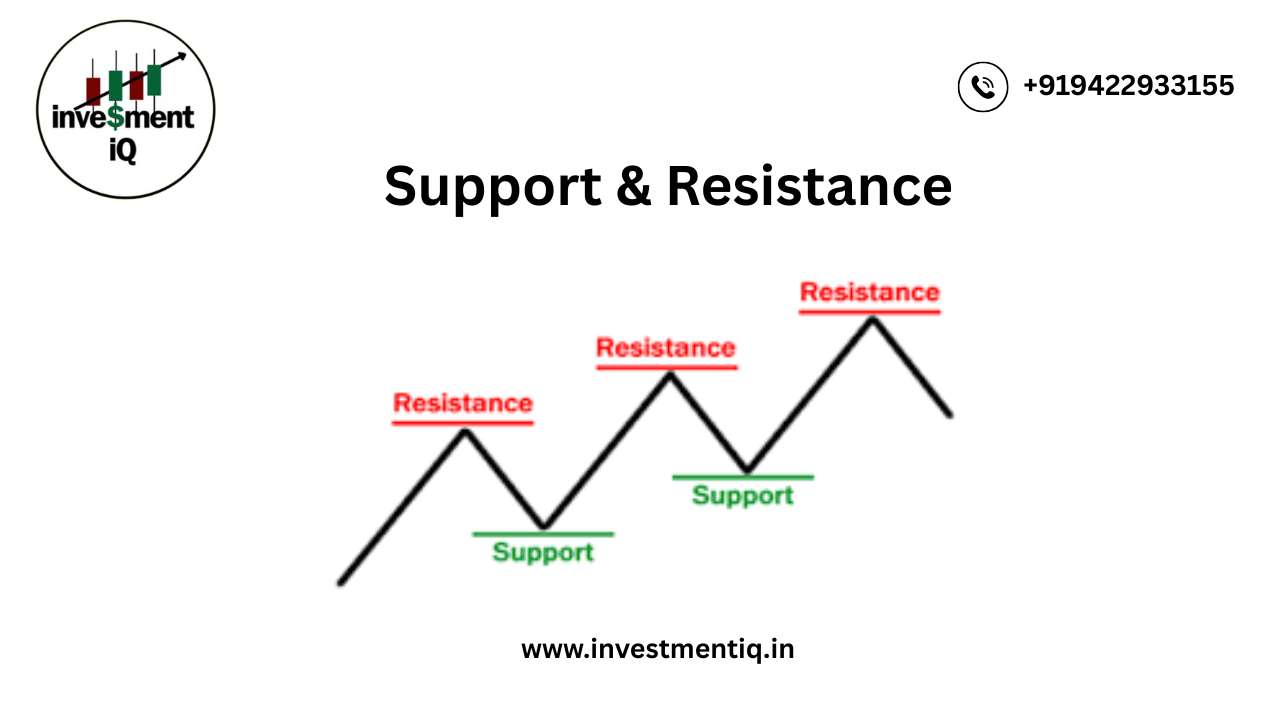

Support and Resistance—In Simple Words Key points where supply and demand collide are represented by levels of support and resistance. Excess supply (down) and demand (up) are what drive prices in the financial markets. Bears, selling, and supply are interchangeable. Bullish, bulls, and purchasing are all connected with demand. In this and other articles, these names are used interchangeably. Prices rise in response to rising demand and fall in response to rising supply. Prices fluctuate sideways as bulls and bears battle for power when supply and demand are equal. What Is Support? The price level at which demand is believed to be sufficiently strong to stop further price declines is known as support. According to the rationale, buyers are more likely to purchase and sellers are less likely to sell when the price drops near support and becomes less expensive. Demand is expected to outpace supply by the time the price hits the support level, keeping it from dropping below it. Example of support levels on the chart of Amazon.com, Inc. (AMZN) However, support is not always reliable, and a break below it indicates that the bears have defeated the bulls.…

What Is Correlation? In statistics, correlation measures the degree to which two (or more) variables move together. Positive correlation values indicate movement together in the same direction. Negative correlation values…

How Are Charts Formed? There are different chart types. We will focus on the four most popular charting methods—line, bar, candlestick, and point & figure charts. Line Chart The closing level is more significant to certain traders and investors than the open, high, or low.You can disregard intraday fluctuations by concentrating solely on the closing.…

How to Pick a Timeframe The timeframe for creating a chart depends on the compression of the data—intraday, daily, weekly, monthly, quarterly, or annual. The less compressed the data, the…